|

[Philip Morris promo] |

|

A Company With "More Money Than God"

The illustrations at right come from a Philip Morris public relations

campaign. You may have seen this corporate self-promotion on television. Philip Morris is

spending millions of dollars to alert the public of their community service efforts. They

hope Americans begin to view Philip Morris as a "good corporate" citizen. In the

ad, Philip Morris opens by showing a house in need of repair. As a result of Philip

Morris financial assistance, the home is renovated and used as a home for homeless

children.

|

|

Are Things Changing?

We thank Philip Morris for this generous community effort. Although the corporation

spends millions to help families in America -- they spend even more money buying television time to publicize their

"goodwill" activities.

More importantly, the tobacco industry continues to pour billions of dollars into tobacco advertising and

promotion. As a result, an estimated 3,000 children and young teens become addicted to tobacco products

each day.

|

|

a future victim of tobacco addiction?

|

A Forbes.com feature, "Heroes or Zeros" (05.10.01), which assessed the value top executives bring to their respective firms, had a harsh

go at Geoffrey Bible, CEO of Philip Morris:

"Bible's high pay, combined with his company's poor performance, ranks him 246 out

of the 278 CEOs on the value list... It's not as if Bible, 63, invented any exciting new products. Philip Morris bills itself

as a company that sells various consumer products, including cigarettes. But, despite diversification, tobacco sales still

account for 61.5% of the company's sales and 65% of its profits. The only part of the company that grew quickly last year

aside from domestic tobacco was financial services, but that product line was a tiny slice of the company overall... How

tough can it be to peddle cookies and one of the most addictive products the law allows? Bible has also managed to lead

the company into an era where, for the first time, it faces billions of dollars in product liability claims from smokers,

46 states and, perhaps, the federal government."

Advertising and Promotion

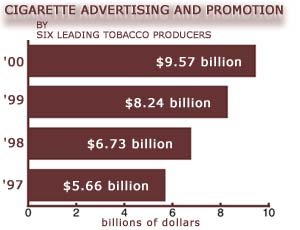

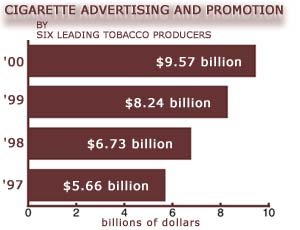

The Federal Trade Commission (FTC) reported total advertising and promotional expenditures

between 1999 and 2000 (most recent data available) by the six largest cigarette manufacturers

in the U.S. [ 1] were "the most ever reported by the major cigarette manufacturers." [ 2].

In 2000, the major domestic cigarette manufactures sold 413.5 billion cigarettes in the U.S. market, 2.2 billion more

than the 411.3 sold in 1999.

The industry significantly increased their percentage of point of sale promotional materials (ads posted at the retail location)

by spending $347.0 million in 2000, an increase of 5.3 percent. The industry reported spending $705.3 million on coupons, an increase

of 32.8 prcent from the $531.0 million spent in 1999. Spending on retail value added (offers such as "buy one, get one free" or "buy

three, get free T-shirt," where the cigarette product and bonus item often are packaged together as a single unit) grew

by $956.6 million (37.4 percent) from 1999 totalling $3.52 billion in 2000. Newspaper advertising expenditures rose slightly between 1999

and 2000, increasing 1.4 percent. Manufactures reported spending $294.9 million on magazine advertising in 2000, a decrease of 21.8 percent

from 1999.

|

The FTC released its annual report on cigarette sales and advertising on May 24th. For 2000 cigarette sales increased slightly (0.5 percent)

from 1999 levels, while advertising and promotional expenditures increased significantly to $9.57 billion. The increase marked

a 16.2 percent increase by the six largest cigarette manufacturers from the $8.24 billion spent in 1999.

The FTC reported aggregate expenditures for tobacco advertising and promotion between 1998 and 1999 increased 22.3 percent from the $6.73

billion from the previous year. The illustration at right provides a comparison of the annual industry expenditures.

|

|

|

Advertising Goals

We can deduce company objectives from a 1988 Philip Morris internal report on the Current Business Situation [ 3].

In this document, the company describes the Marlboro profile: "a primarily young

and male brand, with a high proportion of Hispanic smokers and a low proportion of Black smokers"

[ page 14].

"Marlboro Menthol is building a smoker base very similar demographically to Parent: young, white,

and predominantly male"

[ page 1].

They brag about their product's success: "Marlboro is the largest brand in the industry with twice the

share of its nearest competitor. Its' established packing are the dominant leaders in their

respective product categories

[ page 1].

"Marlboro is the number one selling brand in all trading areas except

Hawaii, where it ranks third behind Kool and Benson & Hedges

[ page 4].

"Marlboro posted share increase among total smokers and most of its key segments: men, women, and agre groups up to

age 44. The fastest growing segments continue to be the youngest smokers... Qualitative research is underway

to investigate Hispanic attitudes toward Marlboro, particularly among the young segments"

[ page 15].

|

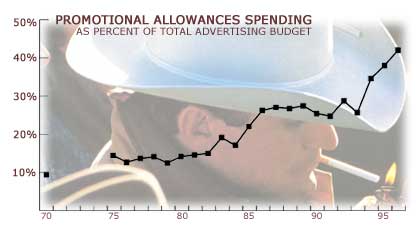

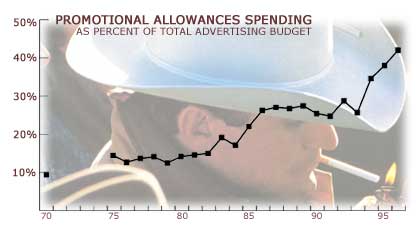

Playing the Switching Game

In a 1994 speech to the National Association of Convenience Stores, Philip Morris executive Jack Dillard reported

"approximately 25% of all smokers switch brands every year -- 30,000 every day. Like other companies, Philip Morris

used coupons and samples to attract consumers to our brands." The industry refers to this activity as Promotional

Allowances ( read industry comments about Promotional Allowances).

While the FTC report shows advertising and promotional spending increased dramatically over the past years

in most areas, the greatest spending increases have come in the form of Promotional Allowances. The illustration below tracks

industry Promotional Allowances spending over time. FTC figures show that for the first reported year (1970), the industry

allocated 9.4% of their $361 million dollar budget to Promotional Allowances. By 1996 (most recent available data), the

industry had exponentially increased Promotional Allowances to 42.1% -- over $2.150 billion dollars.

Actual tobacco industry documents portray a different picture about the "switching game." From the 1988 report, we

learn that, "Marlboro's biggest source of smokers continues to be

smokers with 'no previous brand,' roughly half of whom are starting smokers. In 1987 this group contributed 33% of Marlboro

in-switchers. Internal Marlboro switching is the second largest component... Over the last 3 years more in-switchers have

come from competitors Winston, Salem, and Camel" (7, 7, 4 percent respectively) [ page 2,

19].

How big a problem is "out-switching" to a company such as Philip Morris? Statements from the 1988 document reveal that, "Competitive

outswitching decreased slightly from 5.4% to 5.2% of the franshise in 1987. Both years are well below the 1985 figure of 7.0%"

[ page 17].

This document notes the discount cigarette market poses the greatest threat to the established brands. Simply put, established smokers

are more sensitive to price than they are to advertising. Advertising is for kids! Silly rabbit.

Specifically, "For the total industry Price Value took 20% of all switchers.

Marlboro's losses to PV were proportional to the industry's. Winston, Salem and Camel gained slightly more smokers than they

gave up to Marlboro" [ page 17].

This Philip Morris market study also revealed that, "The limited switching data available indicate that Marlboro

Menthol is drawing a substantial number of Kool smokers, followed by Newport and Salem. Still, 20% of the in-switchers are from

another Marlboro packing."

Interestingly, "More than half of Marlboro outswitchers move down the tar spectrum. [Marlboro] Lights catches a fraction of these; most leave

the brand to completing [sic] low tars or ultra lows. Approximately one quarter of Marlboro outswitchers move to full flavor products,

direct competitors of Red and Gold" [ page 18].

Marlboro outswitchers were abandoning their regular Marlboro cigarettes, a full-flavor (high tar) brand, as

consumers sought "more healthy" cigarettes. Advertisers rarely make tar level comparisons -- tobacco advertising focuses on

image creation.

NOTES:

[1] The six largest cigarette manufacturers in the United States (in alphabetical order) are: Brown & Williamson Tobacco Corporation,

Commonwealth Brands, Inc., Liggett Group, Inc., Lorillard Tobacco Company, Philip Morris Incorporated and R.J. Reynolds Tobacco Company. [top]

[2] Download PDF copy of 2001 FTC Cigarette Report for 1999 (158k). [top]

[3] CURRENT BUSINESS SITUATION [top]

19880700/E

BRAND REVIEW

Source: Philip Morris -- 2048678626/8644

[1] [2] [3] [4]

[5] [6] [7] [8]

[9] [10] [11] [12]

[13] [14] [15] [16]

[17] [18] [19]

© Copyright InfoImagination, Scott Goold, director

|

|

|

|